If you’re 70½ or older, you can donate up to $100,000 per tax year directly from an Individual Retirement Account (IRA) to charities like Center for Safety & Change as a Qualified Charitable Distribution (QCD).

QCDs, also known as IRA charitable rollovers or IRA gifts, may be excluded from your taxable income and qualify towards your required minimum distribution (RMD).

Qualified Charitable Distribution (QCD) rules:

QCDs count toward your required minimum distribution for the year. If you have to take your required minimum distribution but you don’t want or need the funds, QCDs are a good way to distribute the amount out of the IRA. As an added benefit, you’ll avoid paying income tax on your gross income up to $100,000.

QCDs cannot be made to a donor-advised fund (DAF), charitable remainder trust, or charitable gift annuity. A QCD can be made to your sponsoring 501(c)(3) organization if there are programs that you can fund outside of your DAF. Such purposes include general support for the charity or for other programs they may maintain outside of their role as a DAF sponsor.

For additional information on QCDs and DAFs, please contact your charitable sponsor.

How to make a QCD to Center for Safety & Change:

They can mail the check to:

Legal name: Center for Safety & Change Inc

Address: 9 Johnsons Lane, New City, NY 10956

Federal tax ID#: 13-2989233

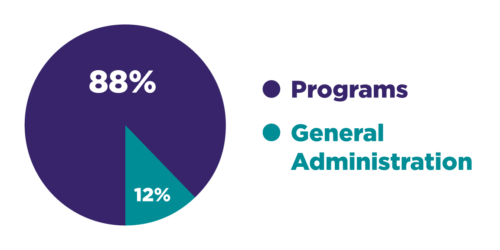

Learn how your Legacy gift will be used:

To learn more about how your Legacy gift will be used, read more about our work, our impact or view our financial information including our latest financial statements.

Questions?

Email development@centersc.org or call (845) 634-3391 to learn more about planned giving.